This post originally appeared on Inside the Bid, our series on untangling mobile ad mediation for studios across Southeast Asia.

How $1 CPM from advertisers can shrink to just 30–50¢ in publisher revenue – and how cutting the hops boosts yield, reduces adtech tax, and puts more premium revenue back in mobile publishers’ pockets.

In the first post, we unpacked the mediation blind spot – the demand you never see because of how mobile mediation works.

But that’s just one piece of a bigger problem: the adtech maze.

Every extra hop in the chain takes a cut, slows delivery, and hides opportunities. The good news? The supply chain is shifting – and the studios that adapt fastest will capture more revenue and keep more control.

The Basics: Who’s Who in the Ad Supply Chain

At its core, digital advertising has two sides:

- Buy Side (Demand Side): Brands and agencies (advertisers) paying to show ads to specific audiences.

- Sell Side (Supply Side): Owners of apps, websites, or other media (publishers) selling ad space.

The buy side pays the sell side for ad impressions – usually in CPM (cost per thousand impressions).

Today, most ads aren’t traded directly between these sides – instead, they flow through a chain of technology platforms that connect buyers and sellers in what’s known as programmatic advertising.

The Programmatic Middle Layer

Source: The Stack by Tracy Phan

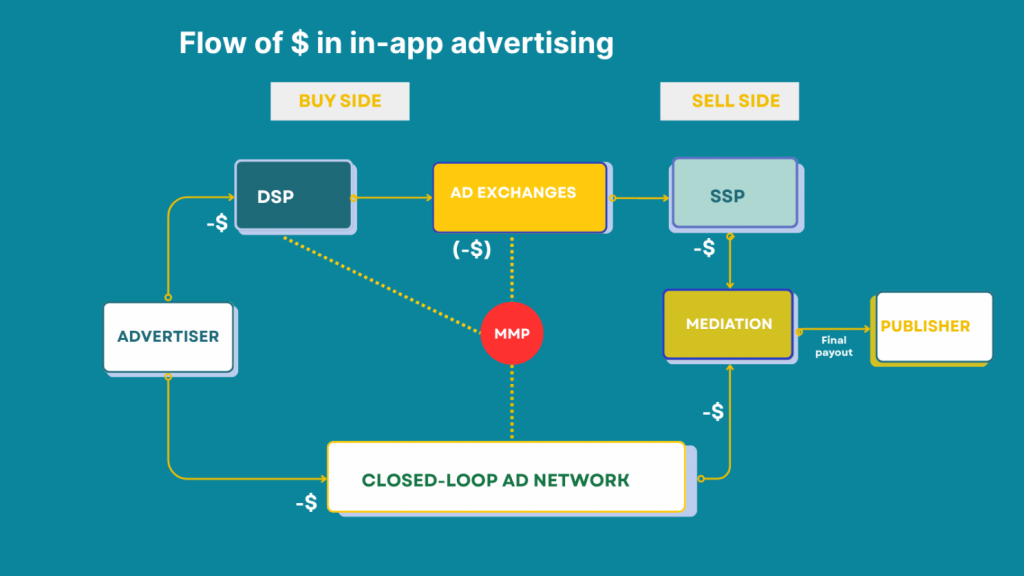

In programmatic advertising, several key players sit between advertisers and publishers:

Demand-Side Platforms (DSPs): Used by advertisers to buy inventory across sources, set targeting, and manage budgets.

Supply-Side Platforms (SSPs): Platforms publishers use to manage and sell their ad inventory to multiple demand sources.

Ad Exchanges: Marketplaces where DSPs and SSPs transact – typically via the OpenRTB protocol for real-time bidding, including private deals and other programmatic transactions.

Data Management Platforms (DMPs): Collect, organize, and activate audience data so advertisers and platforms can make more informed targeting and bidding decisions.

Ad Networks: Aggregate inventory from publishers, package it by audience or category, and sell to advertisers – often directly, sometimes programmatically.

In mobile in-app monetization, another key player is the mediation platform – connecting publishers to multiple SSPs and ad networks in one place, promising maximum yield from each impression. At least, that’s the promise.

The Problems

All the programmatic players exist to add value to one or more steps of the supply chain, and in exchange, they charge a fee for the value they provide.

That’s the expectation. But the reality is messier. The ad supply chain is full of inefficiencies, blind spots, and competing incentives that quietly chip away at performance and revenue.

Fragmentation = Adtech Tax

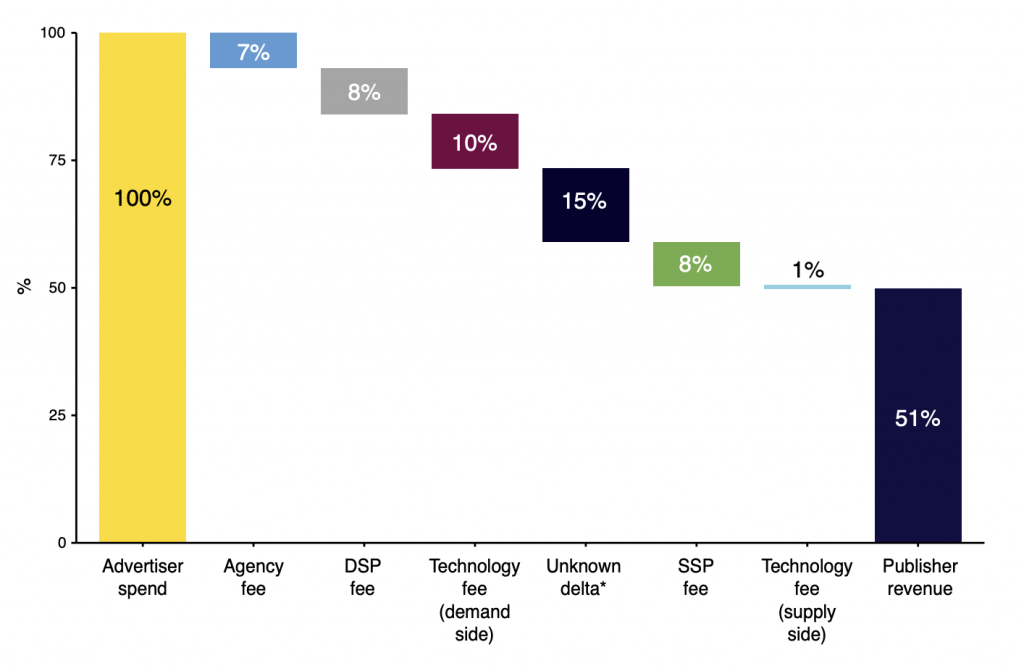

Every intermediary takes a cut (either % of media spend, CPM markup, or revenue share). Some deliver measurable value; others simply pass data along, adding cost without actually improving outcome.

In a fragmented ad ecosystem, the same impression is often resold through multiple paths before reaching a buyer – in fact, industry data shows a single impression may be presented up to 30 times through combined direct and rebroadcasted supply chains.

Industry studies from ISBA and PwC have found that publishers, on average, received only 51¢ for every $1 CPM. And in a distressing scenario, a Guardian experiment found the publisher only received 30% of the advertiser’s spend, with the remainder lost somewhere in the supply chain.

Source: ISBA/PwC supply chain transparency study, 2020

Complexity Breeds Inefficiency

As impressions bounce through multiple hops, transparency erodes. Sometimes the same company controls several of those hops, e.g. an SSP might also operate as a DSP, or own a mediation platform, creating opaque chains of control. These overlaps make it harder to realize where value is added – and where it’s simply extracted.

In-App: The Closed Loop Problem

Mediation platforms are built to help publishers access more demand, though often in practice, much of the revenue comes from a few large closed-loop ad networks, typically owned by the mediation platforms thereby creating conflict of interests, in other words, the auction isn’t truly neutral, and these networks are favored over others. Most of their ads promote other mobile games within the same ecosystem, creating a zero-sum game where every dollar gained by one studio is a dollar lost by another. The bigger loss? Premium brand advertisers, DSPs, and buyers outside mobile often never get to bid – if they’re in the room at all.

The Shift: Supply Paths Are Shortening

Digital advertising is rapidly evolving, and buyers are rethinking how they access inventory. Two major trends are reshaping the ecosystem:

Supply Path Optimization (SPO)

Advertisers and agencies are analyzing their buying routes and cutting out inefficient or redundant hops. By consolidating spend through the most transparent, cost-effective paths, they reduce fees and gain more control over where ads run – for example, concentrating budgets with SSPs that have direct integrations with top apps, and avoiding inventory resold through daisy-chained intermediaries.

Direct-to-Supply Buying

Some major players are now bypassing traditional intermediaries altogether.

In February 2022, The Trade Desk launched OpenPath, enabling direct connections to premium publishers – including in-app inventory. The performance gains can be significant. For example, Freestar publishers saw 3× higher fill rates and a 27% increase in programmatic revenue, underscoring the impact that direct buyer access can have on yield.

On the supply side, some SSPs have also introduced direct-buy tools for brands and agencies, effectively skipping the DSP layer in certain deals. For example, PubMatic and Magnite have both launched direct-buy offerings in CTV, a signal that shortening supply paths is gaining traction across channels.

What Mobile Studios Can Do Now

Mobile publishers sit at the very end of the ad supply chain – every other player is effectively a buyer of your inventory. Yet mediation often keeps studios locked in, favoring its own network or select partners while others get leftovers. The result? Missed opportunities for higher CPMs, better fill rates, premium deals, and visibility into who’s buying.

Improving retention or ARPDAU by 10–15% can take months of work. But did you know that shifting premium demand out of mediation and connecting directly has, in some cases, delivered eCPM uplifts of up to 30–100% – plus fill rates that surprise even seasoned teams?

The shifts toward shorter, more efficient paths are already happening – and the studios that act now will capture more of the budget. That starts with knowing who you work with, how your inventory reaches buyers, and where you can take back control.

1. Qualify Your Demand Partners

- Map where they sit in the supply chain.

- Ask: do they add measurable value beyond being a “pipe”?

- Know their take rate and whether it aligns with what you get.

Quick win: Drop low-value partners and reallocate that traffic to higher-performing, more direct demand.

2. Bring Your Inventory Closer to Demand

- Fewer hops mean better yield.

- Look for the shortest path from campaign budget to your inventory

- Remember: lines between SSPs and DSPs are blurring.

Quick win: Identify 1–2 demand partners you can connect to via direct OpenRTB or server-to-server integration.

3. Think Beyond Mediation

- Consider a complementary stack you control, with full visibility

- Use it to connect directly to demand your mediation can’t (or won’t) provide.

Quick win: Start with one premium demand partner outside mediation and benchmark its performance side-by-side.

Bottom line

The adtech maze isn’t going away any time soon.

The mobile publishers who win will be those who figure out where value can be gained by plugging the leakage, and gaining clarity on their supply paths, while shortening the route to premium budgets as much as possible, thus generating more revenue and gaining better control.

Want to follow the series?

Subscribe to Inside the Bid to get new posts straight to your inbox.

Want to talk through your own ad monetization challenges?

Reach out here — we’d love to hear from you.